In 2024, North Sea Port recorded a 0.7% increase in seaborne cargo transhipment, reaching a total of 66.3 million tons, continuing its positive trend despite the current economic and geopolitical challenges.

Inland navigation saw even more impressive growth, rising by 4.4%, reflecting the port’s robust performance in a time of global uncertainty. This upward momentum is particularly encouraging given the impact of geopolitical tensions and economic shifts.

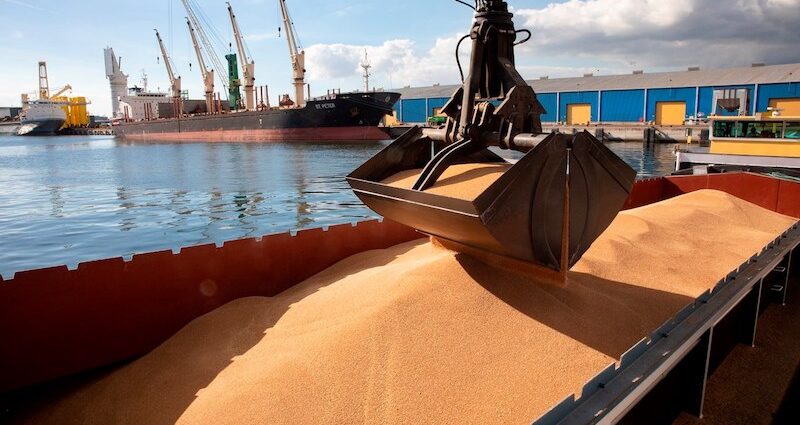

While seaborne transhipment experienced a modest rise of 0.4 million tons, the bulk sector continues to drive growth. Dry bulk and breakbulk (general cargo) saw significant increases, while liquid bulk shipments dipped, reflecting cautious demand from the industrial sector. The port’s diversified operations serve as a stabilizing force in uncertain times, balancing declines in some sectors with gains in others.

The port’s trade with Great Britain surged by more than 25%, making it North Sea Port’s top trading partner. This suggests the effects of Brexit are now largely behind, with the port continuing to solidify its role at the heart of European trade.

Inland waterway transhipment also flourished, expanding by 5%. North Sea Port’s strategic location at the intersection of major inland waterways, alongside sustainable transport initiatives like modal shift projects, has enhanced its ability to manage bulk goods efficiently via waterways.

Expansion and Investments Ahead

Looking to the future, North Sea Port is poised for significant investment. In 2025, the port expects to release 30 hectares of land, mirroring the progress made in 2024, as part of its ongoing growth strategy in energy, offshore, logistics, and circularity sectors. These investments are expected to create new jobs and enhance the port’s financial stability.

While the industry faces challenges, such as fluctuating demand for liquid bulk and geopolitical uncertainties, North Sea Port remains confident that recovery is on the horizon. With European industrial policies and sustainability efforts in mind, the port is set to continue its upward trajectory.

Bulk Ports Lead the Way

Dry and liquid bulk continue to dominate, accounting for nearly 75% of all transhipments. Dry bulk grew by 2.1% in 2024, reaching 35.9 million tons. The rise was driven by increased imports of iron ore, wood pellets, chemicals, and soya beans, with construction materials also holding steady. Breakbulk increased by 7% to 10.2 million tons, led by higher volumes of cellulose.

Meanwhile, liquid bulk fell by 3.5% to 14.6 million tons, largely due to reduced shipments of petroleum products and biodiesel. Container transhipment saw a decline of 18%, totaling 1.8 million tons, reflecting a shift in demand for these goods.

Agricultural products, ores, and fertilizers all posted strong growth, while sectors like petroleum products and metal industry products saw declines.

Trading Partners and Global Reach

Great Britain emerged as North Sea Port’s leading trading partner in 2024, with 6 million tons of cargo transhipment, up 26% from the previous year. The UK surpassed the United States, which experienced a 6% decline in trade. Other notable growth came from Sweden, which saw an 8% increase, moving it into third place.

Europe remains the dominant region for trade, accounting for 58% of the port’s cargo traffic. North America and South America followed with 14% each, while Asia and Africa accounted for 3% and 7% respectively.

Inland Navigation Shows Resilience

Inland navigation also showed strong results in 2024, with total transhipment reaching 64.2 million tons, an increase of 4.4%. Liquid bulk rose by 7%, while dry bulk grew by 5%, bolstered by higher volumes of animal feeds, sand, and gravel. However, container transhipment faced a 15% decline, reflecting a broader trend in the sector.

Despite these challenges, North Sea Port’s inland navigation remains steady, with the import-export ratio maintaining balance at 41%-59%.

Overall, while 2024 presented its challenges, North Sea Port’s diversification and strategic investments position it for continued growth, making it a key player in European trade and logistics.